Complex Transactions

Representing Buyers and Sellers in Complex Bankruptcy and Distressed Assets Transactions

Consider this — most parties involved in a complex business asset or stock purchase transaction should be represented by an attorney. An innocent mistake, oversight, or careless error could mean big trouble for you, and place your investment at risk. These risk factors can be multiplied exponentially when combined with the complexities of the United States Bankruptcy Code.

Regardless of your position in the deal, include the attorneys of Jennis Morse on your team. Let our skilled and experienced attorneys work on your behalf in negotiating, structuring, and closing your transaction smoothly and with favorable results.

A Strategic Approach to Complex Transactions and Acquisitions

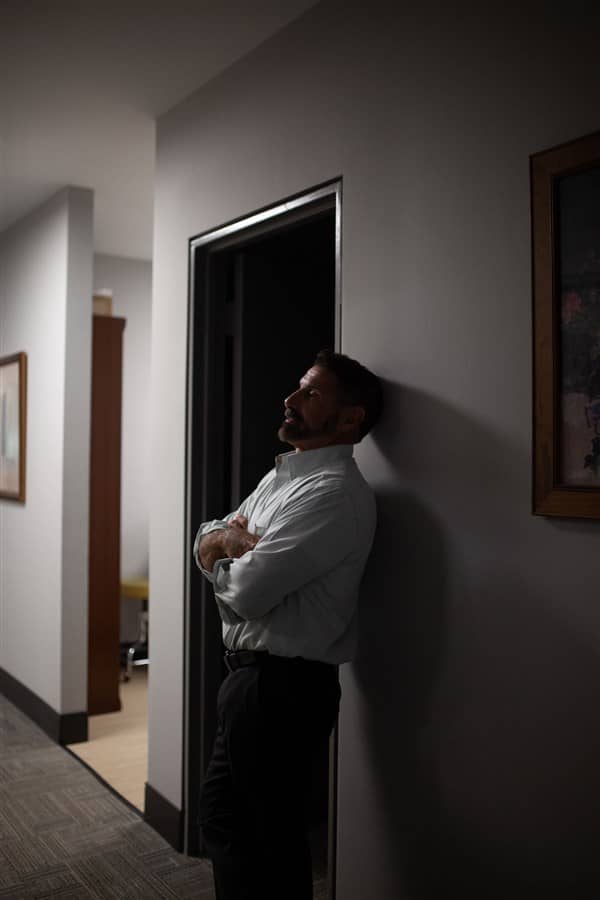

The tone for the Jennis Morse approach is set by attorney Dave Jennis, one of the firm’s partners, which involves understanding the client’s needs and concerns and placing them in a strategic framework that’s greater than an individual transaction. Leveraging that approach, a transaction that was preceded by a bankruptcy filing can represent a strategic opportunity with upsides for all parties.

In addition, Jennis Morse clients benefit from more personalized attention from founder Jennis, partner Bernard “Chip” Morse, and the firm’s team of attorneys. With specific solutions tailored to each client, the firm’s approach is more “hands-on” for each case than at larger firms.

A Value Proposition

Bankruptcy can be an emotional and stressful process, but can also present a positive opportunity, with value present — for example, when real estate assets are involved — that can be unlocked.

For investors, lenders, or buyers, Jennis Morse attorneys are adept at presenting opportunities in the bankruptcy arena for value propositions that may not be available under normal circumstances. Examples of investment types include:

These and other mechanisms can create opportunities to process distressed assets, while bolstering the long-term financial health of an organization or individual and creating value.

The Jennis Morse attorneys thoroughly explain the risks involved, which can be more moderate than expected, due to the mechanisms inherent in the bankruptcy process. With more than thirty years’ experience each by two of the partners, the firm’s attorneys use their experience and understanding of the law to create investment vehicles for clients, including many who wouldn’t be able to profitably engage in certain transactions without the presence of a bankruptcy.

Business, Financial, and Real Estate Expertise

The wide-ranging areas of expertise of Jennis Morse attorneys benefit clients involved in complex transactions or acquisitions by virtue of the team’s deeper toolkit of resources, including long term expertise in financial and real estate matters. In addition, the firm’s partners — business owners themselves — are known for viewing cases through a business lens, rather than just a litigious one.

Ultimately, the process by which a plan for each Jennis Morse client engaged in a complex transaction is derived, is created by an approach based on listening and empathy, enabling the firm to best match its many skill sets to the client’s needs.

Jennis Morse has represented:

- Chapter 7 and 11 trustees through free and clear sales of distressed restaurants (both independent and part of a franchise)

- Chapter 11 individuals who sold real estate property, e.g. rental homes, free and clear both before and as part of their plans of reorganization

- Chapter 11 commercial landlords who utilized the bankruptcy process to re-finance their multi-million dollar office complex