Bankruptcy News & Trends

Bankruptcy law in 2021 is dynamic, with many trends affecting those filing for bankruptcy or being impacted by it. Major national trends include:

- The new Chapter 11 Subchapter V for small filings

- The 2021 American Rescue Plan passed in early March, as well as the two 2020 CARES Acts (the CRRSAA or Coronavirus Response and Relief Supplemental Appropriations Act, and the CARES Act or Coronavirus Aid, Relief, and Economic Security)

- PPP (Paycheck Protection Program) loans while in Chapter a11

- Accelerated trend towards large bankruptcies filed in Delaware

On a more local scale, trends affecting bankruptcy law in Florida include:

- Bankruptcy judge repositioning in the Middle District

- Increasing caseloads in all three Florida districts – North, Middle, and Southern

National Trends – Chapter 11 Subchapter V

Overview – Subchapter V (“Sub V” for short) is a type of Chapter 11 bankruptcy passed by Congress which went effective in February 2020. It allows a small business debtor to obtain a discharge on the effective date of the plan, provided the plan was consensual, among other advantages. A Sub V is generally a quicker, easier, and less expensive alternative to a traditional Chapter 11.

Numbers – since its creation, a little over 1,000 Sub V’s have been filed nationwide, which is about 20% of the 5,051 Chapter 11 bankruptcies filed nationwide in 2020. The total for Sub V’s includes 127 in Florida. The Middle District of Florida in particular led the nation with Sub V filings where Etlinger has the privilege of confirming the first Sub V case. Etlinger expects to see a lot of Sub Vs in 2021 from service companies (CPA firms, printers, etc.).

Benefits – can be substantial for those choosing a Sub V filing rather than Chapter 11, especially during the recent period in which the cap was raised from $2.7 million to $7.5 million in debt. However, that increased debt cap was due to expire recently unless Congress extended it through March of 2022. Only time will tell if Congress makes the move on a permanent basis.

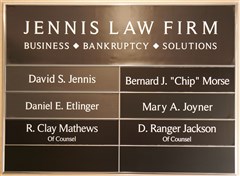

Outlook – Jennis Morse Etlinger has been increasing its personnel resources in expectation of greater volume in 2021. Beyond Sub Vs, those filing Chapter 11 bankruptcies will likely include restaurants and small breweries, service companies (plumbers, etc.) and very small offices (1-5 employees).

2021 American Rescue Plan

Overview – this federal act, signed into law on March 11, 2021, builds on the prior CARES Acts (passed in March and December 2020) and contains provisions to help businesses manage or avoid bankruptcy.

Benefits – This much needed legislation gave additional life support to many businesses to stay afloat. In general, the lending climate is strained but upbeat. As the COVID-19 threat subsides, there will be more clarity on which businesses are not able to sustain debt and will need to consider reorganizing.

PPP Loans

Overview – the PPP was implemented to provide funding for eligible small and nonprofit businesses to maintain their payroll, hire back employees who may have been laid off, and cover certain overhead.

Benefits – one key aspect of PPP loans is that bankrupt entities cannot receive them. There was significant litigation throughout the nation over this point. The 2021 legislation attempted to address this but tensions remain between debtors seeking to qualify for a PPP loan and the SBA.

Bankruptcies Filed In Delaware

Overview – Etlinger expects the Delaware bankruptcy courts to be very busy in 2021, with a lot of big cases come through, potentially including JC Penney and other large filers. Expect the Delaware courts to see massive dockets, including a traffic jam of Fortune 1500 companies that didn’t get (enough) pandemic relief.

Florida Trends & Analysis – Judge Turnover

Overview – there are several new judges expected to be seated in various Florida jurisdictions this Spring, including in Orlando and Jacksonville. Candidates are currently being vetted and interviewed.

Effect – The bankruptcy bar is a very tight community with the judges playing key roles in the fates of businesses undergoing bankruptcy. Florida has historically had outstanding judges and the expectation is that all three of Florida’s districts will continue to maintain an excellent balance of business judgment, practical legal approaches, and quick access to the courts.

Trends in Florida’s Three Legal Districts

Overview – Jennis Morse Etlinger is based in Tampa, within Florida’s Middle district, a bar that’s seen as stable with a lot of good attorneys. The Northern district is poised for growth. The Southern district continues to reflect the dynamism of Miami and South Florida’s business world, and judges there have a great breadth of experience in terms of international business and finance.

Analysis – Jennis Morse Etlinger has a Florida and Southeastern perspective on the courts. While the venue for a bankruptcy case is largely determined by the business footprint, Jennis Morse Etlinger has a wealth of experience in front of many of the state’s judges. The success of a bankruptcy filing depends mostly on business and legal dynamics, but understanding the courts is key to obtaining the best outcome.